en.m.18dao.net

The directive from the government follows months of delay following the death of President Meles Zenawi last August.

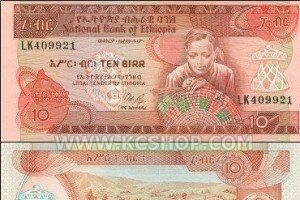

Economists believe that the move will further encourage economic growth, with banks and microfinance institutions (MFIs) now set to provide mobile banking. The first such service, M-Birr, named after the country’s currency, is set to start pilot testing later this month.

“Clients of banks and MFIs will be able to make deposits and withdrawals through their mobile phones,” the directive said. “They can also make payments to businesses or transfer money to clients using their mobile phones.”

The National Bank of Ethiopia had previously turned down requests from local banks for mobile money services to be allowed.

M-Birr ICT Services Plc General Manager Thierry Artaud told African Business Magazine that the new service will provide domestic money transfers, withdrawals and savings, as well as account balances, airtime top-up, salary payment, loans repayments and, later, international remittances.

“The potential for mobile services is untapped,” he said. “Until now, customers who had no access to the traditional financial institutions had no other way than cash transactions. M-Birr will open new possibilities.

“The system is ready, the team is in place, the first pilot testing will start in January. M-Birr has signed an exclusive commercial agreement with the five MFIs to provide them with the system.”

These five institutions account for 95 percent of the microfinance business in Ethiopia.

“During the pilot testing, M-Birr will have about six retail outlets per region, which will equate to about 30 outlets nationally with a view of fast expanding the network within 18 months,” added Artaud.