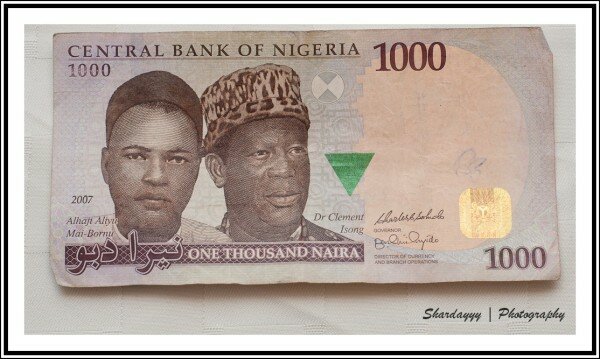

CC image courtesy of Shardayyy, on Flickr.

The Central Bank of Nigeria (CBN) has announced new guidelines that will subject banks using third party electronic payment solutions not been licenced by the central bank NGN10 million (US$60,000).

The new guidelines on spell out the roles and responsibilities of all stakeholders in the end-to-end electronic payment of salaries, pensions, suppliers and taxes.

“When a bank uses an unlicenced third party e-payment solution for end-to-end e-payment of salaries etc, the CBN would suspend its e-payment operations with the bank, issue a warning letter to the managing director and impose a fine of NGN10 million for every repeated occurrence,” the CBN said.

Banks that do not have help desks or contact centres to receive enquiries, complaints and provide feedback on e-payment issues will also have their end-to-end e-payment operations suspended until the conditions are met.

“End-to-end electronic payment is the seamless electronic processing and payment of all forms of salaries, pensions, suppliers and taxes with the electronic delivery of associated schedules alongside the payment transactions where applicable on a bank-approved electronic platform which transmits the instruction to debit a payer’s account and credit a beneficiary’s bank account, mobile account, electronic wallet or any other electronic channels; and shall include the ability of a payer to independently monitor and obtain electronic feedback on the status of any payment, at any time without depending on any third party, manual or semi-manual means,” the CBN said.

“This means payment instructions and associated schedules are no longer to be transmitted to deposit money banks (DMBs) by all public and private sector organisations through unsecured channels, such as paper- based mandates, flash drives, compact discs (CD), email attachments , etc.”