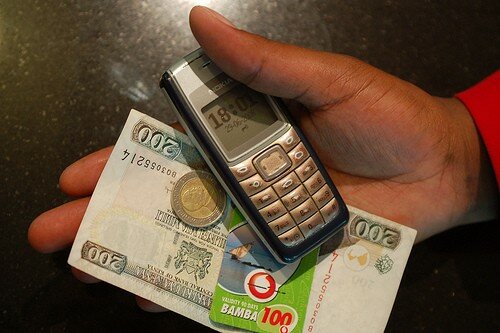

CC image courtesy of whiteafrican on Flickr

The Kenya Bankers Association has launched its “Credit Calculator Online” website and mobile application informing loan applicants of the components that make up the total cost of credit as a percentage – known as the Annual Percentage Rate (APR).

Both the site and the app were developed by the KBA in conjunction with the industry’s implementation of the Kenya Banks’ Reference Rate (KBRR) and the APR pricing mechanism.

They also feature tools for borrowers to use when making a loan decision, including a quick APR estimate and a comprehensive calculator that captures all the costs associated with a loan facility. The mobile app can be downloaded from the site or Google Play.

Speaking during the launch, KBA chairman Joshua Oigara said it is anticipated KBRR and APR will enhance pricing transparency while stimulating competition within the banking industry.

“Promoting transparency in lending remains a priority for the financial services sector and for banks in particular, we therefore are thankful to our stakeholders, including the Central Bank of Kenya and the National Treasury, for their partnership in this quest to enhance access to credit through progressive and enabling policies,” he said.

“Beyond interest rates, there are other costs that influence access to credit. And through the Cost of Credit Committee the government, regulators and industry have identified priority initiatives to address these inefficiencies.”

Among them include reforms of the Lands and Companies Registries; establishing the legal and regulatory framework to support the creation of an electronic movable assets register; and expanding credit information sharing beyond KBA member banks to all regulated banks and other entities, including non-bank credit providers, utilities and mobile network operators.

“With these and other initiatives that will be overseen by the Cost of Credit Committee, I fully believe that as a country we will ultimately have a more efficient credit system and, enhanced access to credit,” Oigara said.