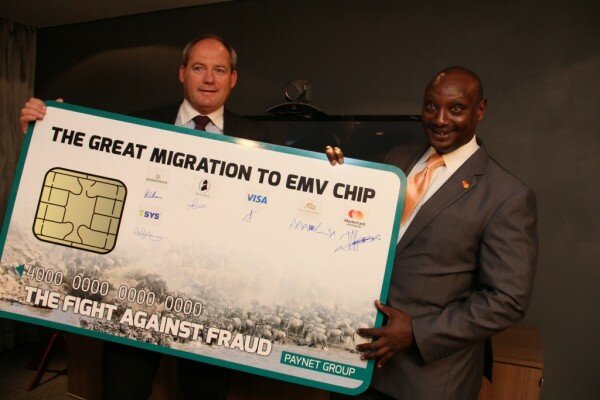

Bernard Matthewman, CEO – Paynet Group and James Wainaina, vice president and area business head – MasterCard East Africa

MasterCard Kenya has signed a deal with regional card processor Paynet Group to partner in a local initiative dubbed “The great migration to EMV chip” which is geared towards encouraging the switch from magnetic strip to EMV cards.

The initiative brings together various stakeholders in Kenya’s banking and payments technology sectors in an effort to hasten the switch to the Europay Mastercard Visa (EMV) cards a globally accepted standard for enhanced card payments security.

With the Kenya Bankers’ Association having set the deadline for the migration to EMV to March 2014, Paynet has been embarking on a training programme, which has educated players in the industry on various models that bankers can use before the migration as well as the benefits of chip and PIN cards.

Speaking during the signing ceremony yesterday, Paynet chief executive, Bernard Matthewman, said the rising instances of card fraud had caused concern in the industry, as banks continue to experience high levels of fraudulent card transactions.

“It is important that we move rapidly to safeguard consumer confidence,” Matthewman said.

“We believe the partnership with MasterCard today and the joint effort of all other stakeholders in “The Great Migration to EMV Chip” will further grow the momentum of the campaign and enable this market reap the benefits of a highly innovative and secure card payments industry.”

According to statistics from the Banking Fraud Investigations Department (BFID), financial institutions lost an estimated KSh1.49 billion (US$17 million) to fraud between April 2012 and April 2013.

While the losses were not all attributed to card fraud, the increase in card usage, especially among the middle class, has necessitated the formulation of tougher measures to fight fraud, making the case for the adoption of the more secure chip and PIN cards.

James Wainaina, vice president and area business head for MasterCard, said that despite Kenya recording impressive growth in card usage measures have to be put in place to cushion card users against fraud.

Wainaina said: “But while we celebrate these impressive gains in card use, we also recognise that to maintain our momentum we must do everything within our power to put in place measures that make it impossible for fraudsters to operate, and to constantly assure our customers that their card transactions are safe.”

Most Kenyan card users (98 per cent) use the magnetic strip cards which are vulnerable to fraud, unlike the EMV cards which are embedded with microchip to encrypt information, making it more difficult for unauthorised users to copy or access data on the card.

Paynet also recently launched an EMV card issuing and processing facility in Nairobi that will support local banks opting to outsource their card operations.